The Revised Capital Market Master Plan 2015-2025 (RCMMP), developed by the Securities and Exchange Commission (SEC) Nigeria in collaboration with stakeholders, has been described as capable of providing a blueprint to harness these opportunities to better position the capital market as the engine of our economic growth and development.

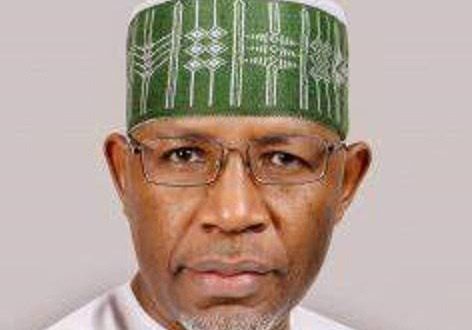

Director General of the Securities and Exchange Commission, Mr. Lamido Yuguda who stated this recently, disclosed that the Master Plan captures the challenges of the capital market in actualizing its role to drive national economic growth and also proffers solutions to enable the capital market attain its full potentials.

Yuguda stated that Nigeria in the last decade has firmly emerged as one of the leading frontier markets in Africa with immense potential for significant growth as the aspiration of the Government to create opportunities for the private sector to be a major engine of growth that guarantees improvement in the welfare and standard of living of the citizens of our great country has been diligently articulated in Nigeria’s Medium-Term National Development Plan (MTNDP) 2021-2025.

According to him, “The MTNDP emphasizes development of a deep, broadened and competitive financial system that is better positioned to support private sector growth and economic diversification. Capital Markets provide a useful means to mobilize capital and harness economic interests in an efficient manner to drive innovation and growth.

“The last decade has been characterized by significant volatility in the global financial system caused by various economic and health shocks. At the same time innovative technologies have significantly disrupted how markets operate.

The SEC Boss said the first five years of the original Capital Market Master Plan 2015-2025 (CMMP) implementation focused on market and governance reforms in the aftermath of the global financial crises of 2008 and the Nigerian market correction that continued into 2009, with significant success.

“During that period, stock certificates were dematerialized, dividend management was automated, corporate governance standards were improved, intermediaries were strengthened through revised capital requirements and risk based supervision, amongst several other initiatives implemented under the CMMP.

“Today, we face new challenges and opportunities. The pursuit of innovation and growth requires that we are open to opportunities and risks. Our choices are limited if we only seek opportunities within our traditional boundaries. Similarly, we inhibit our ability to grow if we do not curtail the threats of unregulated risk taking. Promoting entrepreneurial and innovative outcomes, therefore, requires balancing our openness and more appetite for risk-taking with the critical need to protect investors. It is important to contextualize our aspirations within the fundamental objectives of market integrity and investor protection while pursuing economic growth.

He said that the RCCMP has provided a framework and outlined strategic initiatives that will help embrace and unlock these opportunities in the capital market.

While commending the Honourable Minister of Finance, Budget & National Planning Mrs. Zainab Ahmed for her unflinching support, Yuguda assured that together with market stakeholders, the SEC intends to lead the implementation of the RCMMP over the next four years and in-line with the objectives of the MTNDP. This he said is a critical success factor in the quest to fulfil the dream of a prosperous and peaceful Nigeria for all citizens.

To position the Nigerian capital market as a key market in Africa, SEC Nigeria developed the 10-year CMMP in 2015. The CMMP is a blueprint for positioning the Nigerian capital market as an efficient and internationally competitive market that can support Nigeria’s emergence as a top 20 global economy in line with Vision 20:2020 The CMMP was developed to assist the government to achieve its strategic economic development program by facilitating an environment that attracts capital to priority economic sectors and ensures the sustained interest of foreign investors in Nigeria.

The Commerce Africa African Reneissance

The Commerce Africa African Reneissance