The Corporate Affairs Commission, (CAC) is poised to fight to a standstill terrorism-financing, money-laundering, ilicit-financial flows perpetuated through registered companies.

This is in keeping with the renewed efforts to make the nation’s foremost Company registry, Corporate Affairs Commission, comparable with its peers globally

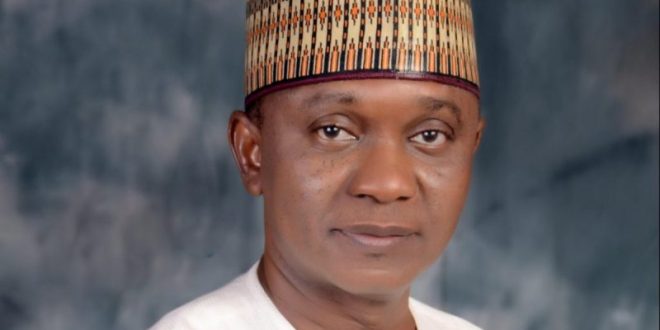

CAC’s Registrar-General, Alhaji Garba Abubakar, said this in an interactive session with Journalists in Abuja on Friday.

He said: “The whole essence of it is to support the anti corruption initiative of the government. We cannot talk of terrorism-financing, money-laundering, ilicit-financial flows without talking about companies”.

The CAC boss said the Companies and Allied Matters Act, (CAMA) had to be reviewed and also re-enacted in 2020, in order to provide a legal framework to support the Beneficial Ownership Register, (BOR).

Abubakar said it was expected that the BOR about to be unveiled on Thursday, May 25, would bring experts from within and outside the country together.

Abubakar said the law provided the framework for disclosure of persons with significant control, which is the same as the beneficial owners.

He said: “And this is further confirmed by the National Inherent Risk Assessment that was carried out in 2022, in conjunction with the Nigerian Financial Intelligence Unit,

(EFCC and ICPC).

“We decided to adopt UK model of persons with significant control which is broader and wider in scope, as opposed to the narrow concept of beneficial ownership.

“So what is provided in the CAMA, Section 119 is that if you are holding shares up to five per cent either directly or indirectly.

”Or you control veto right of any company, up to five per cent whether directly or indirectly, or if you exact some form of influence or control in the way and manner a company is managed.

“Or you have any trust arrangement or other schemes whether registered or not, that emphasises any form of such control you have to disclose this information to the company within seven days of qualifying as such.

“And the company has to submit this information to the CAC within 30 days and the CAC will publish this information,” Abubakar said.

He said: This is one of the few information that is publicly available to the entire members of the public at no cost.

The Registrar-General also said that the Register, would provide the public with these records of share holders of companies via its portal free of charge.

The Registrar General said there was a limit to the transactions an individual could carry using his own personal bank account as most of the procurement frauds were carried out using companies.

The CAC boss was therefore hopeful that the full implementation of the register, would ensure that investigations were facilitated

This was even as information would be open to the Civil Society Organisations, media and the public to interrogate and ask questions

The Commerce Africa African Reneissance

The Commerce Africa African Reneissance