Ebuka Daniel

The Securities and Exchange Commission on Friday said the total unclaimed dividends in the Nigerian capital market stood at N170bn as of December 2020.

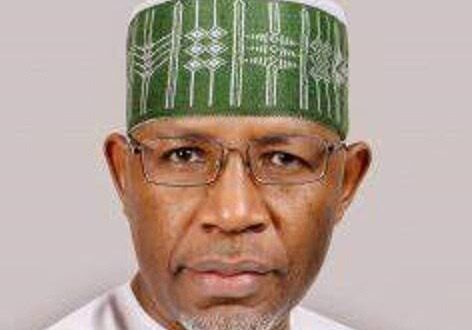

The Director-General, SEC, Mr Lamido Yuguda, said this at the second post-Capital Market Committee (CMC) virtual news conference.

Yuguda said the figure had increased compared with N158.44bn total unclaimed dividends as of December 2019.

He attributed the rising figure to identity management and multiple subscriptions of investors.

We have problems with identity management in the Nigerian capital market and this is really one of the things the commission is trying to resolve.

We have set up a high-powered committee to look at the issue, people bought shares under false names and multiple subscriptions.

“There is a problem with the process but there is a problem with us too as people because if you are buying securities using your own wealth; why will you use another person’s name, why will you use a name that will not be traceable to you?

“This became an issue after the introduction of BVN because BVN is tied to only one name,” Yuguda said.

He noted that the commission constituted a Committee on Identity Management for the Nigerian Capital Market in June in order to address the unclaimed dividend issue.

“The committee is chaired by Mr Aigboje Aig-Imoukhuede and is expected to harmonize various databases of investors, and facilitate data accuracy in the market.

“We are optimistic that the outcome of this committee’s assignment would address the challenges of identity management and help resolve some of the issues we face in the areas of unclaimed dividend, direct cash settlement and multiple subscription,” he added.

He cautioned the investing public against making hasty investment decisions when the returns on such investment are too attractive.

The SEC DG assured that the commission will continue to work with relevant agencies of government and other critical stakeholders in the capital market to tackle the issue of ponzi schemes.

He urged every capital market operator to conduct their businesses within the market functions approved for it by the Commission.

The SEC Boss said the Commission will not hesitate to deal decisively with any operator who carries out any activity outside the function approved for it by the Commission

He said, “The Commission continues its campaign against illegal operators in the capital market, especially Ponzi Schemes and has adopted multi-level engagements with media platforms and regulators of publicity agencies in order to curb the reach and activities of these illegal operators.

“While we continue our activities to resolve the complaints that have been forwarded to the Commission through the official channels, it is important to reiterate to the investing public to be wary of unscrupulous schemes that promise unrealistic returns on investment.

“We will like to use this opportunity to reiterate our commitment towards zero tolerance for market infractions. We urge every capital market operator to operate within the market functions approved for it by the Commission.

“The Commission will not hesitate to deal decisively with any operator who carries out any activities outside the function(s) approved for it by the Commission.

“No capital market can grow without discipline and adherence to laid down Rules and Regulations.

On the performance of the capital market, he said the Committee observed that market performance has been mixed, driven largely by domestic and global economic factors, the impact and responses to the pandemic and the regulatory environment.

In line with its mandate, he said the Commission has been working on some initiatives that would put the market on the path to recovery.

The Commerce Africa African Reneissance

The Commerce Africa African Reneissance